Life insurance is a financial product designed to provide financial protection and support to your loved ones in the event of your death. Here are some key reasons why life insurance is important:

Financial Security for Loved Ones: The primary purpose of life insurance is to ensure that your family and dependents are financially protected if you were to pass away unexpectedly. The death benefit provided by the life insurance policy can help replace lost income, cover debts, pay for funeral expenses, and support your family's financial needs.

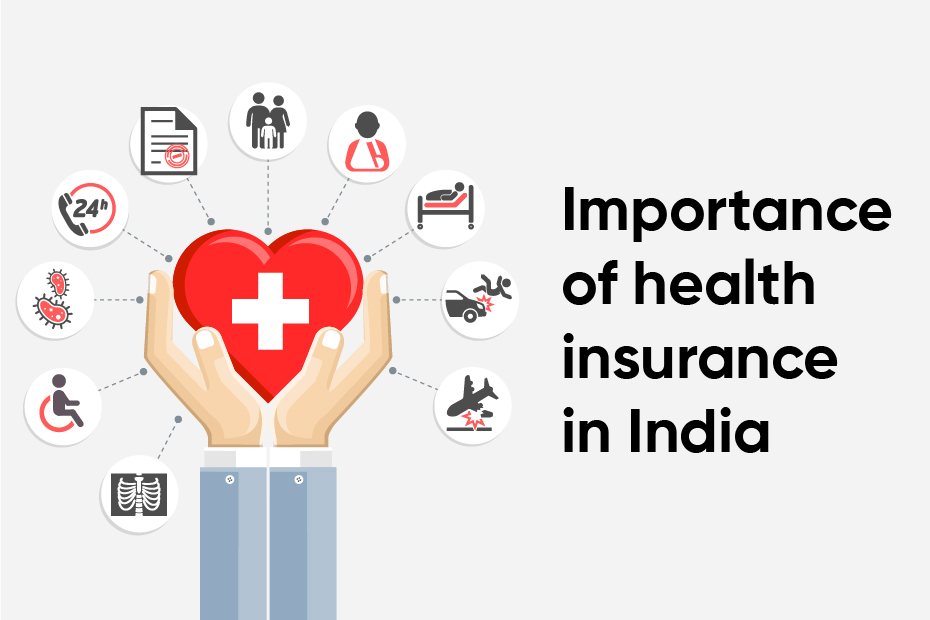

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured person. It helps individuals and families manage the high costs of healthcare by providing financial protection against unexpected medical events or illnesses. Health insurance can be purchased by individuals, families, or employers, and it is also often provided as a benefit to employees by their employers.

Health insurance policies vary in terms of what medical services and treatments they cover. Basic plans usually cover hospitalization, doctor visits, and some diagnostic tests, while more comprehensive plans might include prescription drugs, mental health services, and preventive care.

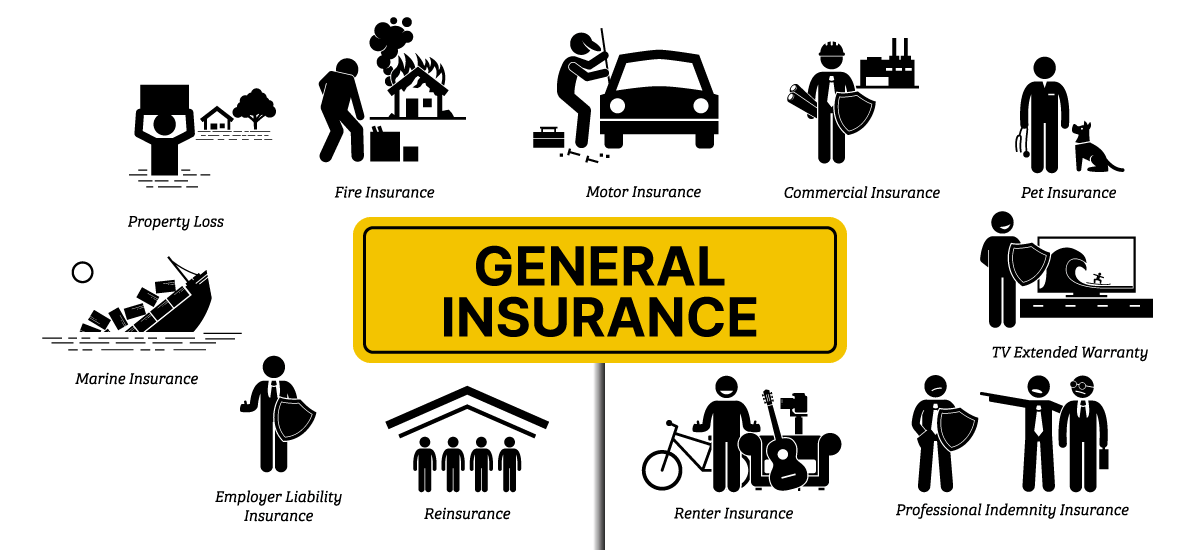

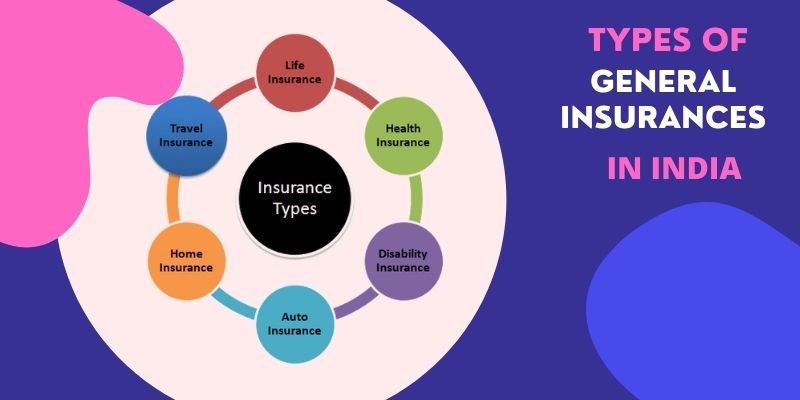

General insurance, also known as non-life insurance, is a type of insurance that provides financial protection against a wide range of risks other than those related to human life. Unlike life insurance, which covers the risk of death or disability, general insurance covers various types of assets, properties, and liabilities. The primary purpose of general insurance is to protect individuals, businesses, and other entities from financial losses that may arise due to unexpected events and accidents.